am i taxed on stock dividends

But if it is an ordinary dividend it will be treated as ordinary income which means the tax hit is. Lazard Ltd NYSELAZ declared on April 27 a 047 per share.

How To Pay No Tax On Your Dividend Income Retire By 40

If you have qualified dividends and the appropriate paperwork however then your dividend tax is one of three figures 20 15 or nothing at.

. You generally pay taxes on stock gains in value when you sell the stock. In the case of qualified dividends these are taxed the same as long-term capital gains. Box 2a Total Capital Gains Distributions.

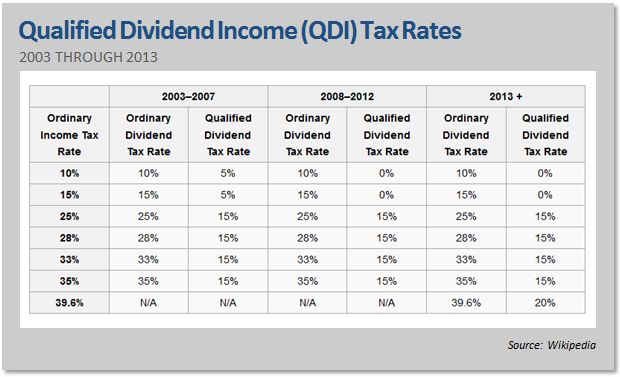

Even if you reinvest all of your dividends directly back into the same company or fund that paid you the dividends you will pay taxes as they technically still passed through your hands. The tax rate on nonqualified dividends is the same as your regular income tax bracket. Lastly investors that were in the four middle brackets 25 28 33 or 35 paid a 15 tax rate for their income derived from qualified dividends.

6 hours agoWith a price to earnings ratio of 651 and a dividend yield of 582 Lazard Ltd NYSELAZ is a notable high dividend value stock. Qualified dividends are dividends that meet the requirements to be taxed as capital gains. Generally any dividend that is paid out from a common or preferred stock is an ordinary dividend unless otherwise stated.

Box 1b Qualified Dividends. If your dividend is qualified it is taxed at more favorable rates of 0 for the two lowest tax brackets 15 for the 25-35 tax brackets and 20 for the top tax bracket. Instead youll pay only when you withdraw money from the account.

The tax rate on dividend income varies depending on whether dividends are ordinary or qualified. For retirement accounts stock dividends are not taxed. Qualified dividends are taxed as capital gains while non-qualified dividends are taxed at the marginal tax rate.

The tax rate on nonqualified dividends is the same as your regular income tax bracket. In a bracket above 35 percent. How Are Dividends Taxed.

And if your income is 434551 or more your capital gains tax rate is 20. You wont pay taxes on dividend income as it comes in. The qualified dividend tax rate.

The taxpayers in the top bracket of 396 used to pay a 20 tax rate on qualified dividend income. Qualified dividends are taxed at 0 15 or 20 depending on your income. To summarize heres how dividends are taxed provided that the underlying dividend stocks are held in a taxable account.

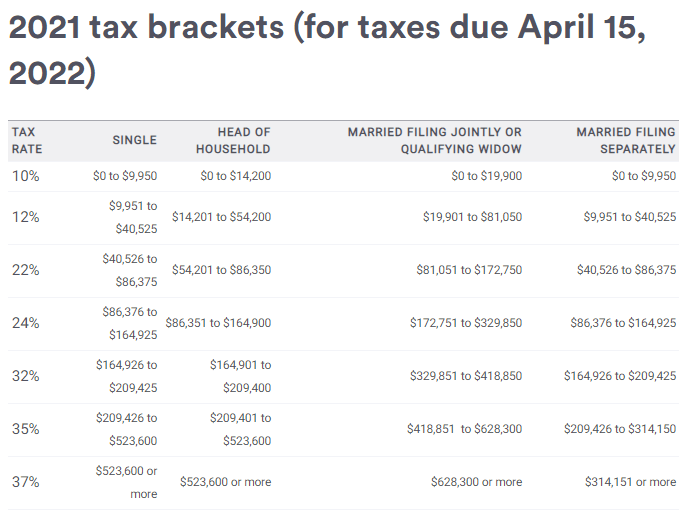

This information is included on the individuals Form 1040. For 2021 qualified dividends may be taxed at 0 if your taxable income falls below. Your qualified dividends are taxed at long-term capital gains rates instead of ordinary income tax rates.

In a non-retirement account qualified dividends are taxed at. Yes dividends earned on stocks or mutual funds are taxable for the year in which the dividend is paid out even if you reinvest your earnings like through a DRIP. Box 2b Unrecaptured Section.

Ordinary non-qualified dividends are taxed at your normal tax rate along with your other income. Taxes on ordinary dividends. High earners are also.

Yes the IRS considers dividends to be income so you usually need to pay taxes on them. Dividends are reported to individuals and the IRS on Form 1099-DIV. Long-term rates are lower with a cap of 20 percent in 2019.

Well lucky you but youll have to pay 20 percent on those qualified dividends and long-term capital gains source. Amounts here are also taxed at long-term capital gains rates. If a stock pays dividends you generally must pay taxes on the dividends as you receive them.

Under current law qualified dividends are taxed at a 20 15 or 0 rate depending on your tax. These dividends are taxed at the same rate as your ordinary income. Theyre a share of corporate profits that are paid out to investors.

If your income is between 39376 to 434550 youll pay 15 percent in capital gains taxes. If your income is lower than 39375 or 78750 for married couples youll pay zero in capital gains taxes. 40001 for those filing single or married filing separately 54101 for head of household filers or.

If you own stocks that pay dividends in an ordinary taxable brokerage account youll need to pay taxes on. 80801 for married filing jointly or qualifying widower filing status. Qualified dividend taxes are usually calculated using the capital gains tax rates.

The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status. Qualified dividends are a type of investment income thats earned from stocks and mutual funds that contain stocks. If youre in the 25 to 35 percent tax bracket your qualified dividends will be taxed at 15 percent.

This presents some special considerations at tax time regarding filing rules and various applicable taxes. Usually the marginal tax rate is. The tax rate on qualified dividends is 0 15 or 20 depending on your taxable income and filing status.

Ordinary dividends are taxed as ordinary income. If you are in the 35 tax bracket a qualified dividend is going to be taxed at 15. Qualified dividends are taxed at a lower rate than ordinary income at the capital gains tax rate.

For stock dividends it depends on the type of account. If you hold stock securities. For 2021 and 2022 individuals in the 10 to 12 tax bracket are still exempt from any tax.

Is Corporate Income Double Taxed Tax Policy Center

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Tax Advantages For Donor Advised Funds Nptrust

:max_bytes(150000):strip_icc()/shutterstock_6286552-5bfc2b3fc9e77c0026b4ebeb.jpg)

Are Stock Dividends And Stock Splits Taxed

Selling Stock How Capital Gains Are Taxed The Motley Fool

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

What S Your State S Dividend Income Tax Thinkadvisor

The Ultimate 5 Step Guide To Maximizing Your Index Etf Returns Young And Thrifty Trade Finance Business Finance Finance Goals

Our Retirement Investment Drawdown Strategy The Retirement Manifesto Investing For Retirement Investing Finances Money

Pin On Legal Tips For Your Business

How Dividend Reinvestments Are Taxed Intelligent Income By Simply Safe Dividends

Pin By Susan Newman On Financial Cash Flow Financial Pay Attention

Restricted Stock Units Jane Financial

Closed End Fund Tax Benefits Or Not Of Distributions Seeking Alpha

Are Lower Tax Preferred Stock Dividends Really A Better Deal Seeking Alpha

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/shutterstock_342649796-5bfc3d8846e0fb00511e30c8.jpg)